[ad_1]

)

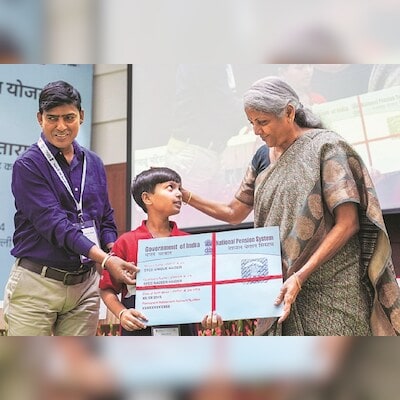

Finance Minister Nirmala Sitharaman launched the NPS (National Pension Scheme) Vatsalya Scheme on Wednesday that will allow parents to save for their children’s future by investing in a pension account. (Photo: PTI)

Finance Minister Nirmala Sitharaman on Wednesday said India is standing out globally in terms of economic growth and will continue to do so in the next few years.

“We are much better off than many other countries; even advanced countries are struggling to grow. We are standing out as an economy growing at the fastest rate in the last few years, this year, and in the next few years as well, for which we can make predictions,” Sitharaman said while launching the NPS (National Pension Scheme) Vatsalya Scheme, which will allow parents to save for their children’s future by investing in a pension account.

Sitharaman’s comment came at a time when Goldman Sachs and Citigroup cut China’s 2024 growth forecast to 4.7 per cent, against the Chinese government’s target of 5 per cent growth. India’s exports to China contracted by 22.4 per cent in August.

The Indian economy grew at 8.2 per cent in 2023-24. The Economic Survey 2023-24 tabled in Parliament in July projected the economy to clock 6.5-7 per cent growth this financial year (2024-25/FY25).

Through NPS Vatsalya, Sitharaman said, children will benefit from the kind of returns that regular NPS funds generate over the long term. “My appeal to all parents is that when you attend a child’s birthday party, you can take cakes or other gifts, but money to invest in NPS Vatsalya will also be a form of gift. It will be a lifelong contribution to the child’s future,” she added.

NPS Vatsalya was announced in the FY25 Budget presented in July. Parents can subscribe to NPS Vatsalya online or by visiting a bank or post office. The minimum contribution to open a Vatsalya account is Rs 1,000. Subscribers will have to contribute Rs 1,000 annually thereafter.

The scheme is an extension of the already existing NPS for children. In the past 10 years, NPS has 18.6 million subscribers with assets under management of Rs 13 trillion.

Children below the age of 18 years can open an NPS Vatsalya account, which will automatically be converted into a regular NPS account upon reaching 18 years of age. Pension will come from the account only upon attaining 60 years of age.

Many lenders, including ICICI Bank and Axis Bank, have joined hands with the Pension Fund Regulatory and Development Authority to launch NPS Vatsalya.

ICICI Bank inaugurated the scheme’s commencement in Mumbai at its service centre by registering a few children’s accounts under NPS Vatsalya.

Speaking on the sidelines of the event, Department of Financial Services Secretary Nagaraju Maddirala, said the government will be receptive to subscriber feedback and improve the pension scheme accordingly.

“Ever since we announced the proposed launch of the Vatsalya scheme, we have been getting feedback and suggestions to improve the scheme. As we proceed and implement the Vatsalya scheme, we will strive to address the concerns expressed over the last week,” Maddirala said.

First Published: Sep 18 2024 | 8:05 PM IS

[ad_2]

Source link