[ad_1]

)

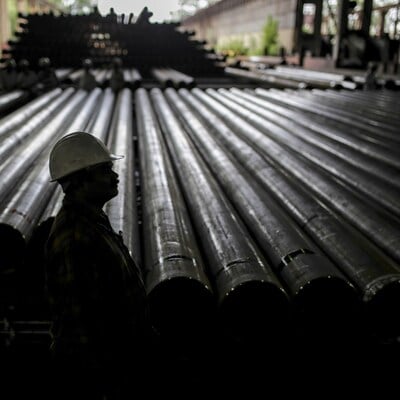

In FY24, India imported 11.2 mt of steel scrap to bridge the demand-supply gap. Bloomberg Photo

The government is expected to mandate automakers to recycle a specified amount of steel from old vehicles, a move that is expected to boost the steel circular economy and nudge scrap availability.

Taking off from the draft regulations on Extended Producer Responsibility (EPR) for end-of-life vehicles issued on January 30, the Environment Ministry is expected to issue regulations asking automakers to recycle or recover from FY26 at least 8 per cent of the steel used in vehicles placed in the market in 2005-06.

The draft regulations specified 10 per cent but the mandate is likely to be kept at 8 per cent, according to sources. The percentage will be increased gradually and go up to 18 per cent in 2035-36. The regulations set a 30 per cent mandate for 2035-36 but the government is likely to keep it at 18 per cent.

According to CRISIL, an additional 0.2-0.25 million tonnes (MT) of steel scrap would become available if automakers increase recycling.

“Although this quantity is modest compared to the overall steel scrap consumption by steel mills, estimated at 29-31 mt for fiscal 2024, it would nonetheless benefit the overall steel ecosystem and contribute to the steel circular economy,” said Sehul Bhatt, director – research at CRISIL Market Intelligence and Analytics.

Steel companies believe that as the sector works to reduce its carbon footprint, improved scrap availability will benefit them. India does not have enough steep scrap and imported 11.2 metric tonne in FY24 to meet demand.

T V Narendran, chief executive officer (CEO) and managing director of Tata Steel, said the mandate for automakers will help formalise the steel scrap market. “Overall, this will have a positive cascading impact and support efforts to lower carbon emissions in the steel industry, thus contributing to a sustainable tomorrow,” he said.

In steelmaking, scrap is a feed material in electric arc furnaces (EAF) and induction furnaces (IF). In the blast furnace-basic oxygen furnace (BF-BOF), the process preferred by steel companies but one that is carbon-intensive, increasing the scrap rate potentially reduces emissions.

As steel companies decarbonise, scrap-based technologies will be crucial for reducing emissions.

Ranjan Dhar, director and vice-president – sales & marketing at steel producer AM/NS India, said even a marginal improvement in the availability of steel scrap will be a welcome development.

“Seaborne trade is anticipated to face heightened restrictions globally as the industry increasingly transitions towards low-carbon steel production,” he said.

“Given the protectionist measures of various countries to retain their scrap for their own steel industry and decarbonisation pathways, scrap availability from imports is likely to be restricted,” said Jayant Acharya, joint managing director and CEO at JSW Steel.

“Hence, it is imperative for us to set up domestic scrap supply chains faster to enable us to move towards India’s decarbonisation journey,” he said.

Indians retain their vehicles for long and therefore, Dhar pointed out, to facilitate a change the country must develop a robust recycling ecosystem.

“In India, automobiles have a longer life cycle compared to other countries. Our income levels are different. As a result, automakers will need to introduce compelling incentives to encourage the return of end-of-life vehicles into the recycling system.”

Steel companies are adding capacity at speed. CRISIL MI&A estimates that large steel players will by 2028 add approximately 50 million tonnes per annum capacity (MTPA), with more than 90 per cent of the addition being BF-based.

“Most large players with existing EAFs are opting for the BF-BOF route for expansion, which limits the use of scrap. Meanwhile, medium and small players are expected to add around 11-15 mtpa of IF (induction furnace)-based capacity,” said Bhatt.

In India, IF-based players are the largest consumers of steel scrap.

Among large companies, about 30 per cent of JSW Steel’s capacity is EAF based. Tata Steel is installing a 0.75 mtpa scrap-based EAF facility in Ludhiana and plans to replicate this model in other cities where scrap is available readily.

First Published: Sep 13 2024 | 2:52 PM IS

[ad_2]

Source link