[ad_1]

)

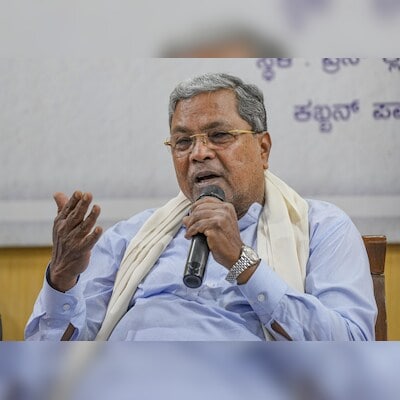

Bengaluru: Karnataka Chief Minister Siddaramaiah addresses a press conference, in Bengaluru, Monday, May 20, 2024. (Photo:PTI)

Karnataka Chief Minister Siddaramaiah has reignited the debate over what he perceives as an “unfair” devolution of tax revenue from the Centre to states with higher Gross State Domestic Product (GSDP) per capita. In a letter to the chief ministers of Kerala, Tamil Nadu, Andhra Pradesh, Telangana, Maharashtra, Gujarat, Haryana, and Punjab, Siddaramaiah expressed concerns about the current tax distribution model.

Taking to social media platform X, the Karnataka chief minister shared, “I have written to the Chief Ministers… regarding the unfair devolution of taxes by the Union government. States with higher GSDP per capita, like Karnataka and others, are being penalised for their economic performance, receiving disproportionately lower tax allocations.”

I have written to the Chief Ministers of Kerala, Tamil Nadu, Andhra Pradesh, Telangana, Maharashtra, Gujarat, Haryana, and Punjab regarding the unfair devolution of taxes by the Union government.States with higher GSDP per capita, like Karnataka and others, are being penalized… pic.twitter.com/SLqpNwVPDA

— Siddaramaiah (@siddaramaiah) September 11, 2024

He also shared images of his letter to Kerala Chief Minister Pinarayi Vijayan. “This unjust approach undermines the spirit of cooperative federalism and threatens the financial autonomy of progressive states,” his post added. The Karnataka chief minister has invited the concerned states to a conclave in Bengaluru to discuss the challenges of fiscal federalism, particularly ahead of the upcoming recommendations from the Finance Commission.

This development follows a protest held earlier this year in New Delhi, where Siddaramaiah, alongside Delhi Chief Minister Arvind Kejriwal, Kerala ministers, and representatives of the Tamil Nadu government, voiced their discontent with the current revenue-sharing formula. These states have frequently criticised the Finance Commission’s methodology, which they argue disproportionately benefits states with slower economic growth and higher population rates.

Understanding tax devolution

Tax devolution refers to the allocation of a portion of Union taxes and duties to the states, enabling them to finance development, welfare projects, and other essential initiatives. As per the recommendations of the 15th Finance Commission, 41 per cent of the divisible pool of Union taxes is distributed among states in 14 instalments each year, covering the period from 2021 to 2026.

Tax devolution: ‘The great divide’

At the heart of this dispute are two primary issues: first, the actual tax devolution to states has been consistently lower than the recommended levels in recent years, and second, the formula used disproportionately benefits less economically developed states, leaving states with higher GSDP per capita, such as those in southern India, with a smaller share of central taxes.

Southern states like Karnataka, Kerala, and Tamil Nadu argue that the Finance Commission’s decision to base population metrics on the 2011 census rather than the 1971 census, as done previously, unfairly penalises them. These states have made significant strides in controlling population growth, which the new formula does not adequately reward. Despite the 15th Finance Commission’s introduction of a demographic performance metric aimed at incentivising population control, the southern states feel they are still at a disadvantage.

For instance, Karnataka claims it receives just 15 paise for every rupee it contributes to the Union, while Kerala and Tamil Nadu receive 25 paise and 29 paise, respectively. In contrast, Uttar Pradesh receives Rs 2.73, and Bihar receives a staggering Rs 7.06 for every rupee contributed. The declining devolution percentages, tied to the Finance Commission’s methodology, remain a point of contention.

Money (approximate) received by states for every Re 1 given to Centre

-

Bihar: Rs 7.26 -

Uttar Pradesh: Rs 2.49 - Maharashtra: 8 paise

- Haryana: 14 paise

- Karnataka: 17 paise

- Gujarat: 26 paise

- Tamil Nadu: 28 paise

Source: Calculations based on the Ministry of Finance’s response in Rajya Sabha

Is the Opposition justified?

The 15th Finance Commission’s formula allocates 15 per cent weight to population and 12.5 per cent to demographic performance, a metric intended to reward states that have curbed population growth. However, critics argue that this method still favours states with larger populations.

It is worth noting that under the 11th Finance Commission (2000-2005), the population weight was just 10 per cent, which was increased to 25 per cent under the 12th Finance Commission (2005-2010) during the UPA regime. While the 15th Finance Commission introduced a 2.5 per cent weight for states demonstrating improved tax and fiscal performance, it is a far cry from the 17.5 per cent weight granted for fiscal discipline under the 13th Finance Commission.

Widening revenue gap

Data from the Union Finance Ministry further highlights the disparity. Between 2015 and 2020, southern states such as Tamil Nadu, Andhra Pradesh, Karnataka, Telangana, and Kerala collectively contributed over Rs 22.26 trillion in GST and direct taxes but received only Rs 6.42 trillion in return. In comparison, Uttar Pradesh contributed just Rs 3.41 trillion yet was allocated Rs 6.91 trillion.

In a post on X in February this year, Siddaramaiah wrote, “Under the 14th Finance Commission (2015-2020), Karnataka received 4.71 per cent of the tax share, which was reduced to 3.64 per cent by the 15th Finance Commission (2020-2025), which is a decrease of 1.07 per cent.”

Under the 14th Finance Commission (2015-2020), Karnataka received 4.71% of the tax share, which was reduced to 3.64% by the 15th Finance Commission (2020-2025). This 1.07% decrease resulted in an estimated loss of Rs 62,098 crore for Karnataka over five years. To compensate, the…

— Siddaramaiah (@siddaramaiah) February 5, 2024

Future of revenue sharing

As more states ramp up spending on social welfare initiatives, the demand for a fairer share of central taxes is likely to intensify. The 16th Finance Commission, chaired by former NITI Aayog vice-chairman Arvind Panagariya, will soon take on the task of revising the tax-sharing formula for the next five-year period starting in 2026. With growing discontent among fiscally stronger states, the upcoming Finance Commission’s recommendations are expected to be closely scrutinised.

First Published: Sep 12 2024 | 12:55 PM IS

[ad_2]

Source link