[ad_1]

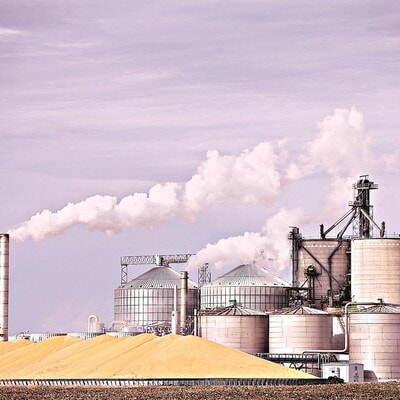

A push by India to make more corn-based ethanol has turned Asia’s top corn exporter into a net importer for the first time in decades, squeezing local poultry producers and scrambling global supply chains.

The jump in import demand comes after India in January hiked the procurement price of ethanol made from corn to drive a shift away from sugarcane-based ethanol for blending in gasoline.

With the government promoting ethanol in gasoline to reduce carbon emissions and trying to ensure ample supply of cheap sugar in the world’s biggest market for the sweetener, India appears set to become a permanent net importer of corn.

The prospect of India ramping up corn imports is likely to support global prices which are trading near four-year lows.

Crushed by soaring feed costs as local corn prices rise far above global benchmarks, India’s poultry producers want the government to remove duties on imports and lift its ban on genetically modified (GM) corn. The prohibition severely limits their buying options.

India usually exports 2 million to 4 million metric tons of corn, but in 2024, exports are expected to drop to 450,000 tons while the country is set to import a record 1 million tons, mainly from Myanmar and Ukraine, which grow non-GM corn, traders estimate.

Traditionally, the poultry and starch industries absorbed most of India’s corn production of around 36 million tons.

Last year, however, ethanol distilleries started using corn, and their demand grew this year after the government abruptly curbed the use of sugarcane for fuel following a drought. That led to a shortfall of 5 million tons, an official with the All India Poultry Breeders Association said.

“Now, the poultry and starch industries are battling with distilleries to get their share of supplies, and this fight is keeping prices high,” said Nitin Gupta, senior vice president of Olam Agri India.

Olam estimates ethanol distilleries will need 6 million to 7 million tons of corn annually, demand that Gupta said can only be met with imports.

Traditional export markets such as Vietnam, Bangladesh, Nepal, and Malaysia, which bought corn from India because of its prompt availability, are now compelled to source supplies from South America and the United States.

“Vietnam has cut down its imports of corn from India recently because India’s prices are too high,” said a Ho Chi Minh City-based trader.

ETHANOL FOR CLIMATE FIGHT

Looking to curb carbon emissions, India aims to increase the share of ethanol in gasoline to 20% by 2025-26, from 13% now.

To achieve its 20% blending target, India will need more than 10 billion litres of ethanol, government estimates show, which is double the volume the country produced in the marketing year ended October 2023.

This year, around 3.5 million tons of corn has been used to make 1.35 billion litres of ethanol, about four times more than a year earlier, government data shows.

“Sugarcane can start contributing more from the next season, but it cannot contribute more than 5 billion litres. The government’s priority is to fulfil domestic sugar consumption,” said a senior government official.

That would mean an increase in corn-based ethanol production to 3 billion litres, requiring nearly 8 million tons of corn, said the official, declining to be named as he was not authorised to speak with media.

POULTRY GROWERS CRY FOUL

Rising corn prices are pushing poultry growers into the red, with feed accounting for three-fourths of production costs.

Uddhav Ahire, chairman of Anand Agro Group in the western city of Nashik, said the farm gate price of a broiler is about 75 rupees, but production costs have risen to 90 rupees.

“The poultry industry cannot sustain such losses for a prolonged period,” he said.

The All India Poultry Breeders Association and the Compound Livestock Feed Manufacturers Association to demand 5 million tons of duty-free corn imports.

A government spokesman did not respond to a request for comment.

“Since there is a shortage, more corn imports should be allowed at zero duty,” Ahire said. “The government should allow GM corn for feed purposes.”

Corn imports attract a 50% import duty, while India allowed imports of around 500,000 tons at a concessional duty of 15%.

Lured by higher prices, farmers such as Krishna Shedge in Jalna district reduced soybean planting to expand the area under summer-sown corn, which has risen 7% from a year ago to 8.7 million hectares, farm ministry data showed.

“Corn is giving good returns due to higher prices,” he said.

But until prices decline with the arrival of new season supply, small poultry farmers like Vijay Patil have limited options including scaling back production and trimming the proportion of corn in feed.

“I’m substituting a small portion of corn with broken rice and wheat stalk waste to reduce feed costs,” Patil said.

TRADE REVERSAL

Booming Indian demand has lifted corn prices in Myanmar to around $270 per metric ton, free on board (FOB), from around $220, encouraging farmers to plant more.

“Exporters, farmers and other stakeholders in the supply chain have benefited from the rally in prices,” said Murali Chakravarthy, country head for Singapore-based trading company Agrocorp in Yangon.

Imports from Myanmar are not subject to tax as it is categorised by India as a least developed country.

Meanwhile, starch makers are bringing in duty-free corn from Ukraine through India’s Advance License Scheme, under which an equal amount of finished goods must be exported.

Ukraine’s exports to India started rising from January and totalled around 400,000 tons by the end of August, estimates ASAP agricultural consultancy.

In the first half of this calendar year 2024 India’s corn imports surged to 531,703 tons from just 4,981 tons a year earlier, while exports fell 87% from 1.8 million tons to 241,889 tons, trade ministry data showed.

“Every year, we will have to import corn, as production can’t be increased as quickly as demand is rising,” said Hemant Jain, an exporter in Indore.

[ad_2]

Source link