[ad_1]

Bilt CEO Ankur Jain explains how members will be able to use their FSA/HSA accounts toward their Walgreens purchases.

Consumers forfeit hundreds of dollars every year from their unused flexible spending accounts (FSA) and health savings accounts (HSA), funds that can help employees pay for certain out-of-pocket health care costs. However, many people do not know how to tap into them.

Bilt, a home and neighborhood loyalty program focused on helping members maximize their biggest expenses, is partnering with Walgreens to ensure those funds are no longer wasted.

As part of its Automatic Healthcare Savings program, Bilt members who shop at Walgreens with any debit or credit card will receive an alert letting them know they have purchased items that are FSA/HSA approved. They can then link their FSA and HSA accounts to the Bilt rewards app. Members will have the option to use those funds for their purchases after the transaction, allowing them to receive a refund to their original payment method.

This allows customers to use the accounts they contribute to through their paychecks without having to do any of the legwork.

“It’s such a painful process today. You have to know what’s eligible. You have to separate the transaction. You have to charge a different card,” Bilt founder and CEO Ankur Jain said.

WALGREENS TO CLOSE ‘SIGNIFICANT’ NUMBER OF UNDERPERFORMING STORES, CUTS PROFIT FORECAST

“With Walgreens, with the payment networks, we’ve created the first automatic FSA program,” Jain said, adding, that “now you don’t have to think about it. And I think that is the secret sauce of a lot of what we are building.”

FSA funds can be used for eligible health care or dependent care expenses throughout the plan year, including deductibles, co-payments, coinsurance, certain medications and medical equipment and supplies.

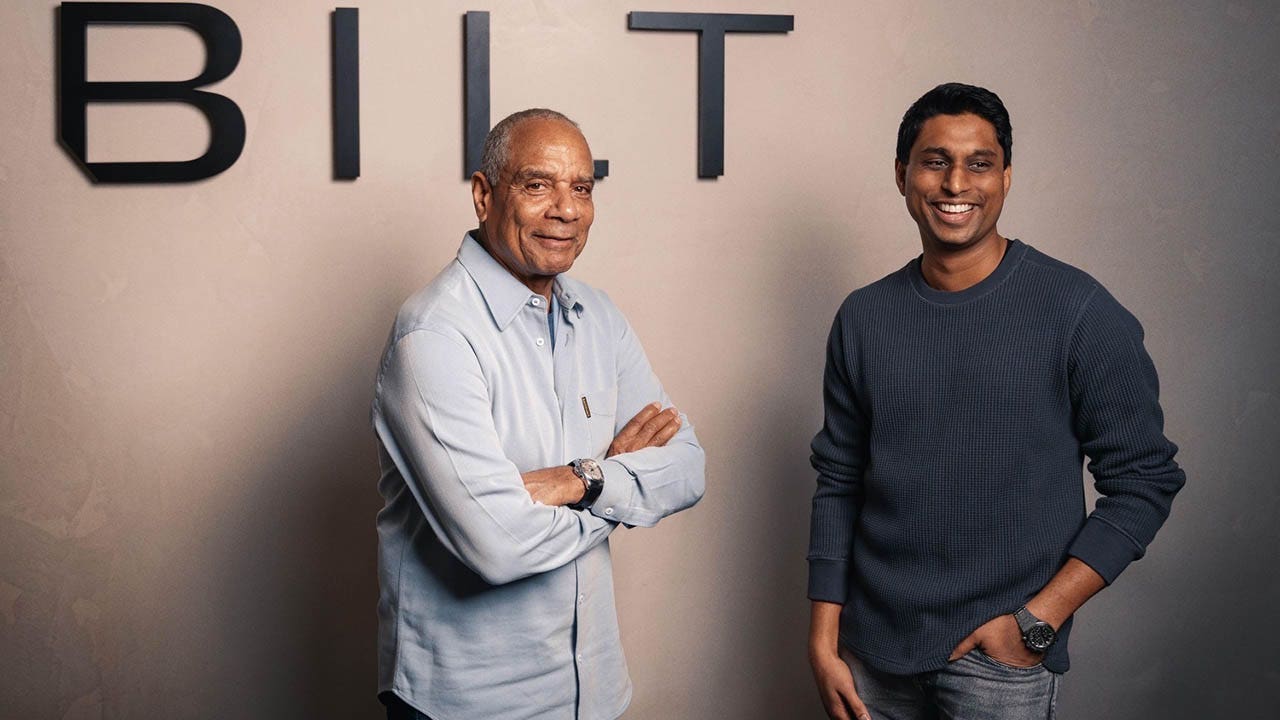

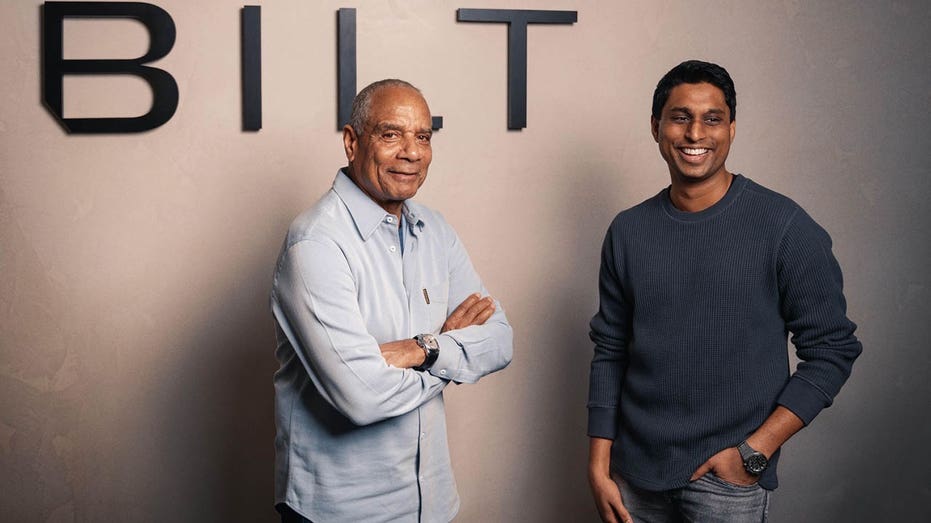

Bilt founder and CEO Ankur Jain, right, and Chairman Ken Chenault. (Bilt)

Any unused money in these accounts reverts to the employer at the end of the year.

According to the Employee Benefit Research Institute, approximately half of FSA account holders forfeited funds to their employers in 2022, with an average forfeiture of $441. Collectively, this amounts to around $4 billion in unspent funds each year, as noted by Jain.

FED’S ACTIONS SPOKE LOUDER THAN WORDS TO MARKETS IN FIGHT AGAINST INFLATION, RESEARCH FINDS

Jain told FOX Business that “there are billions of dollars more that people could put in an FSA or would put in an FSA if it was simple to do.”

People make their way near a Walgreens pharmacy on March 9, 2023 in New York City. (Leonardo Munoz/VIEWpress / Getty Images)

“This collaboration with Bilt, powered by the Banyan Platform, helps enhance the front of store and omnichannel experience for our customers and allows us to offer an unprecedented level of convenience, making it easier than ever for our customers to maximize their health and wellness benefits while earning rewards on everyday purchases,’ Walgreens Chief Product and Growth Officer Bala Visalatha said.

Bilt members can potentially save up to 40% on qualified purchases by participating, but they can also get points on any Walgreens purchase in addition to their credit card points, according to the company.

Bilt members earn 1x Bilt points on all Walgreens purchases, 2x points on Walgreens-branded items, and 100 Bilt points on prescription refills. Those points can be used for things like travel, dining and workout classes.

What is Bilt?

The move is an expansion of the company’s original mission of rewarding customers for their biggest expense every month. After its founding in 2019, Jain focused on how the company could reward people for their rent payments.

People ride an escalator at the Walgreens store near State and Randolph streets in Chicago. (Phil Velasquez/Chicago Tribune/Tribune News Service via Getty Images / Getty Images)

Today, Bilt members can earn points on rent payments at more than 4.5 million homes across the nation. Those points can be transfered for things like travel, dining or fitness classes.

Last year, the company began looking into how they could expand the loyalty program into the neighborhood given that 80% of a person’s discretionary spending occurs within 15 miles of their home, Jain said.

Their neighborhood program essentially rewards members for spending at local restaurants, workout classes and for using Lyft’s rideshare service.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Notably, one of the other biggest expenses in someone’s local neighborhood is health care, Jain said.

“We’ve been thinking about, how do you start to change the health care experience fundamentally from the ground up?” he said, “If we can do that, then you’ll choose to spend locally at health care partners that are working with Bilt because you’ve made it better and more rewarding.”

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| WBA | WALGREENS BOOTS ALLIANCE INC. | 10.30 | +0.27 |

+2.69% |

Jain said there are many ways to solve issues within the health care industry, and noted that the company is “trying to knock them down one by one.”

FSA/HSA benefits provided a big opportunity to solve a complex system with “one simple change,” he added.

This new neighborhood pharmacy benefits program complements Bilt’s existing partnerships with more than 21,000 restaurants, 3,500 fitness studios and rideshare services via Lyft.

[ad_2]

Source link