[ad_1]

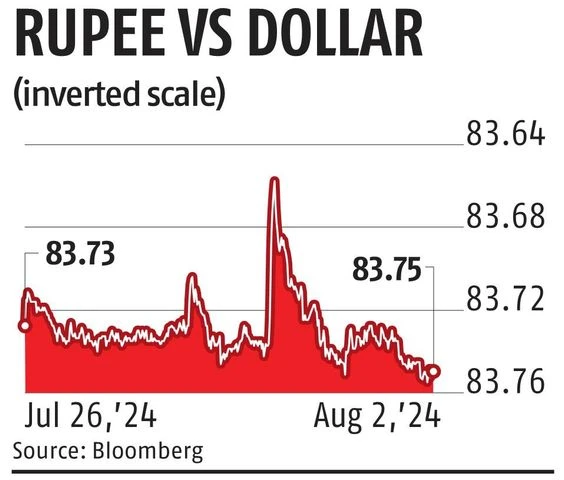

The rupee on Friday depreciated to a new intraday low of Rs 83.76 against the US dollar during the day because selling in equities and domestic demand for the dollar from importers offset the gains from the weaker greenback, said dealers.

The rupee settled at Rs 83.75 per dollar, against Rs 83.73 per dollar on Thursday.

The dollar index fell by 0.27 per cent to 103.92 on the back of favourable US data and dovish comments by the US Federal Reserve. The dollar index measures the strength of the greenback against a basket of six major currencies.

Market participants said the local currency did not depreciate further as the Reserve Bank of India (RBI) intervened in the foreign exchange market through dollar sales.

)

“There was a sell-off in equities and then importers and foreign banks were also buying dollars,” said a dealer at a state-owned bank. “Earlier, the RBI used to intervene in the market after a movement of 3-4 paisa, but now they have been intervening at each paisa movement to sell 100 million-200 million and then leave. This is the new trend now,” he added.

Despite Asian currencies rising, the Indian rupee has been allowed to fall given the currency’s elevated real effective exchange rate (REER), said dealers. According to the latest monthly RBI Bulletin, the rupee’s trade-weighted REER, based on a basket of 40 currencies, was 106.54 in June, indicating that the local currency is more than 6 per cent overvalued.

“Indian rupee fell to a new intraday low of Rs 83.76 per dollar as the State Bank of India continued to buy dollars from the market to make government payments while RBI sold (dollars) at Rs 83.76 per dollar today (Friday),” said Anil Kumar Bhansali, head of treasury and executive director at Finrex Treasury Advisors LLP.

In terms of the REER, the rupee appreciated by 1.8 per cent month-on-month (M-o-M) in June 2024, mainly due to the positive relative price differentials.

First Published: Aug 02 2024 | 6:54 PM IS

[ad_2]

Source link