[ad_1]

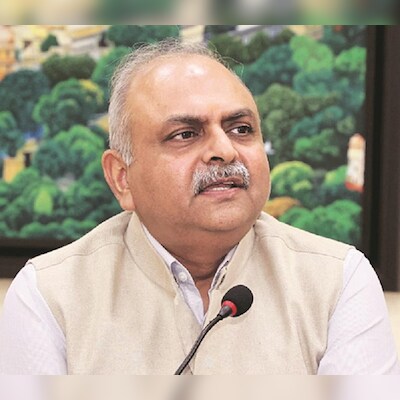

Central Board of Direct Taxes Chairman Ravi Agrawal says the old regime of personal income tax can be phased out once taxpayers in substantial numbers shift to the new one. In a conversation with Shrimi Choudhary and Asit Ranjan Mishra, he says extending the 15 per cent concessionary rate (for companies) depends on how they have utilised the benefit. Edited excerpts:

Any plans to extend the concessionary corporate tax rate of 15 per cent for new units?

No. A decision has been taken to not extend it. We need to see how the companies are utilising the 15 per cent rate, how they perform … Only then will we take a call but ultimately, as on date, it was felt that 15 per cent till March 31 (deadline) was good enough.

Any plans to phase out the old income-tax tax regime, given that two-thirds of the (taxpayers) have shifted to the new regime?

This is a transition phase. People are opting for it and seeing value in it. Sixty-six per cent are there … Over a period once the percentage is substantial, we will see how we take care of the old scheme, but till then it is there.

The time has been further reduced for reassessing cases. What has led to the move?

We have made the reopening process and procedure similar … earlier the 148 provisions (deal with reopening past assessments) were rather complex. And it prompted more litigation. So there is a need to see how to simplify things for the tax department and taxpayers … New changes have been intended to discourage multiple proceedings and notices.

Will slashing taxes on foreign companies boost investment?

Principally we reduced the rate to 22 per cent from 40 per cent for domestic companies and at that point the difference between foreign and domestic companies was 10 per cent. Plus, there has been no reduction in the rate for foreign companies. There has been a long-standing demand from these firms for relief. Since the surcharge is less for foreign firms, making it a 35 per cent effective tax rate would become closer to the regional difference.

There is some exemption also on purchasing foreign assets. What is the thinking behind this?

Earlier there was a threshold of Rs 5 lakh for bank accounts. So it has been raised for up to Rs 20 lakh. This is to address those working in multinationals and getting employee stock options, miss declaring them in their returns, and pay a penalty of Rs 10 lakh, which is more than the value of the asset.

The rationale behind increasing the tax on futures and options?

It is not about curbing speculation. The reality is the number of transactions has increased exponentially, and the stakeholders, the people participating in this, cut across the taxpaying community, including the middle class. The volumes are substantially high as compared to the normal trade and, therefore, one can normalise it. The other point is that if people are participating, there is a case for revenue also. So, both would be taken care of through this.

Thoughts on the comprehensive review of the income tax regime?

The basic mantra is simplification and making it easier for taxpayers to comply, and reducing redundancies. The other is technology. Now it is a technology-driven process to a large extent. So we’ll have to review where we are … we have moved ahead in the last 10 years or so … we have aligned our provisions to a great extent.

We are not rewriting (the law) as such, but then there is a review of where we are and then we can make this Act progressive.

Will this be different from the Direct Tax Code?

Of course.

First Published: Jul 26 2024 | 12:33 AM IS

[ad_2]

Source link