[ad_1]

)

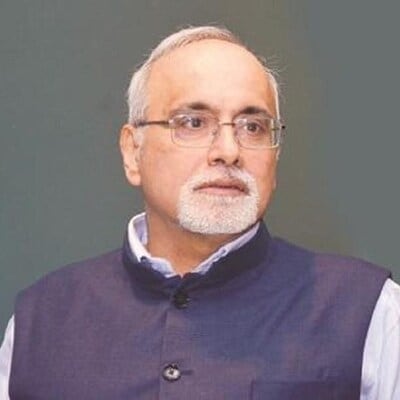

M Rajeshwar Rao, deputy governor at the Reserve Bank of India

Climate-related events can adversely impact the credit quality and loan-repayment capabilities of borrowers, deputy governor of the Reserve Bank of India (RBI) M Rajeshwar Rao said as he underlined the need for a multifaceted approach for a successful transition to a sustainable future.

Rao’s remarks came at J P Morgan India Leadership Series Lecture in Mumbai last week. The speech was uploaded on the RBI website on Thursday.

Climate change can create shocks to monetary stability, economic growth, financial stability, and the safety and soundness of regulated entities, therefore influencing the actions of central banks and regulators, he said.

“Climate-related events can adversely impact the credit quality and loan-repayment capabilities of the borrowers. They can wipe out the assets created from institutional finance, thereby impacting the health of financial institutions,” he said.

Since climate events impact the real sector and, by extension, banks’ exposure to these sectors, they directly affect the risk management frameworks of banks and other financial institutions. Therefore, from both monetary and prudential policy perspectives, central banks play a crucial role in addressing climate risks, Rao said.

“An important point to ponder is that the traditional ways of risk management – risk avoidance, risk mitigation, risk sharing, and risk transfer – may not be fully effective as the financial and other risks from climate change wouldn’t materialise in part or on an individual basis but manifest and impact collectively in a region or industry,” he said.

“Traditional instruments like insurance alone may not be enough to manage the risks arising from such an all-encompassing crystallisation of risks and can overwhelm the insurers,” he added.

Rao highlighted that risks stemming from the climate crisis cannot be managed alone by a single set of actors. Addressing these risks requires the involvement of all stakeholders. He noted that to ensure a successful transition to a sustainable future, there was a need for a multifaceted approach that includes governments, private sector entities, financial institutions, civil society organisations, and the public.

First Published: Jul 25 2024 | 5:27 PM IS

[ad_2]

Source link