[ad_1]

)

ILLUSTRATION: AJAY MOHANTY

The Economic Survey for 2023-24, tabled in Parliament on Monday, asked the private sector to contribute to the creation of approximately eight million jobs annually until 2036. It also cautioned companies against being overly reliant on capital-intensive technologies like artificial intelligence (AI) to reduce employment.

Authored by Chief Economic Advisor (CEA) V Anantha Nageswaran and his team, the 522-page Survey, presented a day before the Union Budgetmade a strong case for seeking foreign direct investments (FDI) from China to boost local manufacturing and tap the export market.

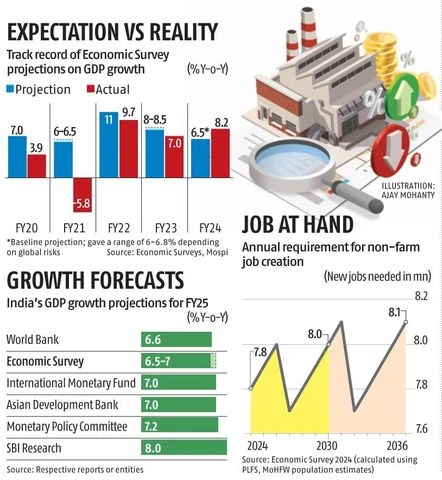

It also set a conservative economic growth forecast of 6.5-7 per cent for 2024-25, at a time when a number of international agencies have lifted their growth projections for India. “We are also mindful of the challenges with regard to progress of the monsoon,” said Nageswaran at a press conference later in the day.

Stressing the need for creating more jobs, the Survey estimated the Indian economy would require an average employment of about eight million in the non-farm sector each year until 2036, based on the expected addition to the workforce and the shedding of jobs by agriculture. In this context, it reminded the corporate sector that job creation predominantly occurs in the private sector, which is currently experiencing unprecedented profitability.

)

“Profits had quadrupled between FY20 and FY23. Businesses are sometimes reluctant to make investments citing lack of demand visibility… Privileging capital over labour is inimical to long-term corporate growth prospects,” the Survey said.

It emphasised that businesses must balance the deployment of capital and labour, and ensure fair income shares between the two. The Survey stressed that in their “fascination” with AI and “fear of erosion of competitiveness”, businesses must remember their responsibility for employment generation and its impact on social stability.

The economic advisors of the finance ministry observed that the corporate sector must think more critically about how AI can augment labour rather than displace workers. This is particularly relevant given the significant slowdown in information technology hiring over the past two years, the Survey noted.

Nageswaran and his team also discussed the role of tax policies in treating capital and labour incomes to reduce inequalities, noting that technologies like AI could have a more detrimental impact on employment and income. However, the CEA later clarified at a press conference that this issue remains widely debated and the country has progressive taxation rates.

Since many factors influencing economic growth, job creation, and productivity fall under the purview of state governments, the Survey advocated for a tripartite compact among the Centre, states, and the private sector. This would help meet the rising aspirations of the population and complete the journey to “Viksit Bharat” by 2047.

In this regard, it called for governments to relinquish some of their power despite it being highly valued. “The tripartite compact needed for this country to become a developed nation amidst unprecedented global challenges is for governments to trust and let go, for the private sector to reciprocate the trust with long-term thinking and fair conduct…”

The survey also nudged private sector financial players to enhance corporate social responsibility by avoiding products that resemble leveraged bets and by curbing the mis-selling of banking and insurance products.

The private sector must foster a culture of long-term investment to meet the infrastructure and energy transition needs in the coming decades, it said. Furthermore, the economic advisors suggested, the private sector should capitalise on traditional Indian lifestyle and food habits to lead the global market.

Policymakers, the Survey suggested, should also maximise the potential of the agriculture sector, address bottlenecks faced by micro, small, and medium enterprises (MSMEs), and deepen the corporate bond markets.

Policymakers must deftly handle the opportunity presented by the China-plus strategy of multinationals. It said India faces two choices: Integration into China’s supply chain or promoting foreign direct investment from that country.

The survey found the latter to be a more promising strategy to boost exports to the US, in line with past successes of East Asian economies.

In general, the Survey advocated for clear policies on transfer pricing and taxes, including import duties, to attract foreign capital.

Despite underestimating economic growth for 2023-24, the Survey cautiously projected economic growth at 6.5-7 per cent for the current financial year. The monetary policy committee projected it to be 7.2 per cent.

Economic advisors of the finance ministry acknowledged this, stating: “The Survey conservatively projects… cognizant of the fact that market expectations are on the higher side.” This conservative approach probably stems from the Survey’s recent track record, with 2023-24 being an exception.

The real GDP stood 20 per cent higher in FY24 than pre-Covid level of FY20, they pointed out.

The 2023-24 Survey found the short-term inflation outlook benign but stressed the need for long-term policy stability by increasing the production of major oilseeds, expanding the area under pulses, and assessing the progress in developing modern storage facilities for specific crops.

It suggested that the Reserve Bank of India’s (RBI’s) Monetary Policy Committee (MPC) consider an inflation targeting framework excluding food, as higher food prices are often supply-induced rather than demand-induced. “Short-run monetary policy tools are meant to counteract price pressures arising from excess aggregate demand growth,” it noted.

The Survey also cautioned that the RBI’s monetary stance could be influenced by any escalation of geopolitical conflicts in 2024, which may lead to supply dislocations, higher commodity prices, and renewed inflationary pressure.

Despite the core inflation rate being around 3 per cent, the RBI has maintained unchanged interest rates for some time, with the anticipated easing delayed, the survey said. It attributed this to the RBI’s dual focus on withdrawing accommodation and monitoring the US Federal Reserve’s actions.

The Survey stated that tax compliance gains, expenditure restraint, and digitisation contribute to achieving a fine balance in the government’s fiscal management.

It suggested that if governments reduce general government deficits to below 7 per cent of gross domestic product on a structural basis, Standard & Poor’s might upgrade the country’s rating, which would itself act as a fiscal stimulus.

First Published: Jul 22 2024 | 9:59 PM IS

[ad_2]

Source link